2014 research from VisitEngland confirms the Darcy research and the McKinsey predictions.

Key Points:

- 20% of day trip market and 14% of the overnight market

- Growth in value 3 times tourism in total, 33% for Accessible Tourism 11% Total Tourism

- Length of stay and average spend both higher

- Over 65 more people with a disability than able bodied

- High percentage of the total market at a young age

In 2015 the Open Doors Organisation conducted further research on the US Economy:

- Disability travel generates $17.3 Billion in annual spending up from $13.6 billion in 2002

- People with a disability travel with one of more adult friends or family putting the total impact at $34.6 billion

- In the past 2 years

- 26 million adults with a disability traveled

- They took 73 million trips

The full report is available from Open Doors

2017/18 Australian Research

In the first piece of new research into the Australian domestic Accessible Tourism market in nearly 10 years, MyTravelResearch were commissioned to do both a qualitative and qualitative study with the aim of determining the current value of the market, the latent demand and the key barriers preventing travel for people with a disability.

The research has placed a total value of the domestic market at $8 billion.

The research looking at Australian domestic tourism only. Early work by Simon Darcy looked at both domestic and inbound and if the same parameters are applied to current NVS data the current estimate for inbound accessible tourism is $2.8 billion.

If domestic and inbound are added together the total accessible tourism market for Australia is 10.8 billion, which is larger than the Chinese inbound market for the same period ($10.4 billion)

The Impact of the Baby Boomers on the Market is Significant.

From the 2015 Intergenerational Report – Australia in 2055

The number of Australians aged 65 and over is projected to more than double by 2054-55, with 1 in 1,000 people projected to be aged over 100. In 1975, this was 1 in 10,000.

The number of people aged 15 to 64 for every person aged 65 and over has fallen from 7.3 people in 1975 to an estimated 4.5 people today. By 2054-55, this is projected to nearly halve again to 2.7 people.

Baby Boomer Attitudes will change the required product mix

It is clear from the demographic data that the Baby Boomer generation will have a significant impact on the tourism market. The Baby Boomers will be unlike any other generation of retirees that have come before it. It is an adventurous and consumer driven generation. Further, unlike previous generations, it will spend its accumulated wealth rather than build a nest egg to pass on to future generations. It will dominate the tourism market for the next 20 years.

The Baby Boomer spending power is significant.

(US Statistics from 2009)

- 70% will inherit $300K average

- Top 8 million $1.5M average

- Total inheritance $8.4 Trillion

- In 2009, households headed by adults ages 65 and older … had 47 times as much net wealth as the typical household headed by someone under 35 years of age.

The Elephant in the Tourism Room

The Tourism Industry sees itself as a “sexy” industry dominated by glamour, youth and activity.

Both the older generation and people with a disability have an image problem and are seen as passive non-involved people. As a consequence they are ignored in the product offering.

“Older people have an image problem. As a culture, we’re conditioned toward youth. .… When we think of youth, we think ‘energetic and colorful;’ when we think of middle age or ‘mature’, we think ‘tired and washed out.’ and when we think of ‘old’ or ‘senior,’ we think either ‘exhausted and gray’ or, more likely, we just don’t think.

The financial numbers are absolutely inarguable — the Market has the money. Yet advertisers

remain astonishingly indifferent to them.”

Marti Barletta, PrimeTime Women

“We are the Aussies. Kiwis, Americans and Canadians. We are the Western Europeans and Japanese. We are the fastest growing, the biggest, the wealthiest, the boldest, the most (yes) ambitious, the most experimental and exploratory, the most different, the most indulgent, the most difficult and demanding, the most service and experience obsessed, the most vigorous, (the least vigorous), the most health conscious, the most female,the most profoundly important commercial market in the history of the world … and we will be the Center of your universe our for the next twent twenty-five years ears. We have arrived!”

Tom Peters

A Program/Customer approach is required in the development of Travel Services to People with a Disability.

Travel, recreation and leisure are all about the “experience” which ideally should be seamless from planning, to arrival back home. Enjoyment comes from those experiences and the way they are shared with others. The experience lingers in the memories of those who participated. A truly remarkable travel experience leaves the visitor changed in some way.

The reason it is so difficult for people with a disability to participate freely is that industry as a whole has not yet recognized that fundamentally a person with a disability is no different from any other person in their aspirations for a remarkable experience.

Industry and organisations still think about access and not the experience. There is a fundamental difference and it stems from a misunderstanding that Universal Design means design for the disabled and not human centered design.

Universal Design is NOT Design for the Disabled

While the business case is strong, it is not tangible to individual business owners and operators or small not for profit service providers. Too often presentations concentrate on big numbers, percentages and 20 page checklists and access statements. What a business owner needs to know is what to do about it, not how big the market is. The size of the market arguments need to be directed at the strategic influencers who’s job it is to translate those trends into tangible action plans based on customer needs.

What is Needed is A Systems Approach

“The essential difference between the frog and the bicycle, viewed as systems, lies in the relationship of the parts to the whole. You can take a bicycle completely to pieces on your garage floor, clean and oil every single part, and reassemble the lot, confident the the whole thing will work perfectly, as a bike, as before. The frog is different. Once you remove a single part, the entire system is affected instantaneously and unpredictably for the worse. What’s more, if you go on removing bits the frog will make a series of subtle, but still unpredictable, adjustments in order to survive. This sort of system, at the level beneath consciousness, wants to survive and will continue for an astonishing length of time to achieve a rough equilibrium as bits are excised – until it can do so no longer. At that point, again quite unpredictably, the whole system will tip over into collapse. The frog is dead and it won’t help to sew the parts back on.”

Intelligent Leadership – Alistair Mant – Allen & Unwin, 1999

Conversely, when there is a well established and sophisticated system, simply bolting on new pieces doesn’t change the fundamentals. Those additional pieces are never nourished and never form part of the overall system. They simply exist on the edge until, through lack of maintenance, they fade away into oblivion.

Tourism and Leisure are examples of well established and very intricate systems aimed at delivering a multitude of different experiences to the customer. The complexity exists both within the destination management structure and within the industry that brings together an array of components to deliver its overall service. A successful tourism/leisure product incorporates, transport, accommodation, attractions, booking systems, information systems and customer service. Those products are bundled and further require the integration of service providers, consolidators, tour operators and an extensive retail network whether online or offline.

Tourism and Leisure are examples of well established and very intricate systems aimed at delivering a multitude of different experiences to the customer. The complexity exists both within the destination management structure and within the industry that brings together an array of components to deliver its overall service. A successful tourism/leisure product incorporates, transport, accommodation, attractions, booking systems, information systems and customer service. Those products are bundled and further require the integration of service providers, consolidators, tour operators and an extensive retail network whether online or offline.

Over time the system evolves as products change and the tastes of the market changes. New products and experiences become available and get incorporated into the overall offering.

Bicycle thinking, where a new product is bolted onto the system invariable fails if it doesn’t fit into the overall management plan or isn’t powerful enough to change the plan.

The approach to accessible tourism and leisure, has to date, largely been Bicycle thinking. Adding accessibility requirements doesn’t fundamentally change a product offering or affect cultural change. The concept of systems thinking in relation to the tourism industry was explored in our paper Accessible Tourism is the Tourism Industry’s Bicycle.

Defining the Customer with a Disability.

An arbitrary line drawn to differentiate a segment of the population whose ability

the majority don’t understand.

While that definition may be tongue in cheek, it goes a long to explain why Accessible Tourism/Leisure has not become mainstream product. Tourism/Leisure is all about creating an experience and a memory. It is about engaging people and taking them into a new realm. The ability to transport someone to a new sensory level requires an understanding of the person for whom that experience is designed and a knowledge of their capabilities to enjoy and appreciate what is going on around them.

People with a disability are present in all sectors in roughly the same proportion as the general population. They are not like the backpackers, adventure tourists, or luxury travelers that can be conveniently put into unique product boxes with targeted marketing campaigns. The common misconception is that the needs of all people with a disability are the same. In one sense that misconception has been reinforced by the social model of disability which, in defining the social barriers, has concentrated on a narrow sub set of physical access requirements largely limited to car parks, toilets, building access and hotel rooms. By concentrating on the narrow access requirements the industry has effectively created an artificial sector of people with a disability that ignored their actual aspirations.

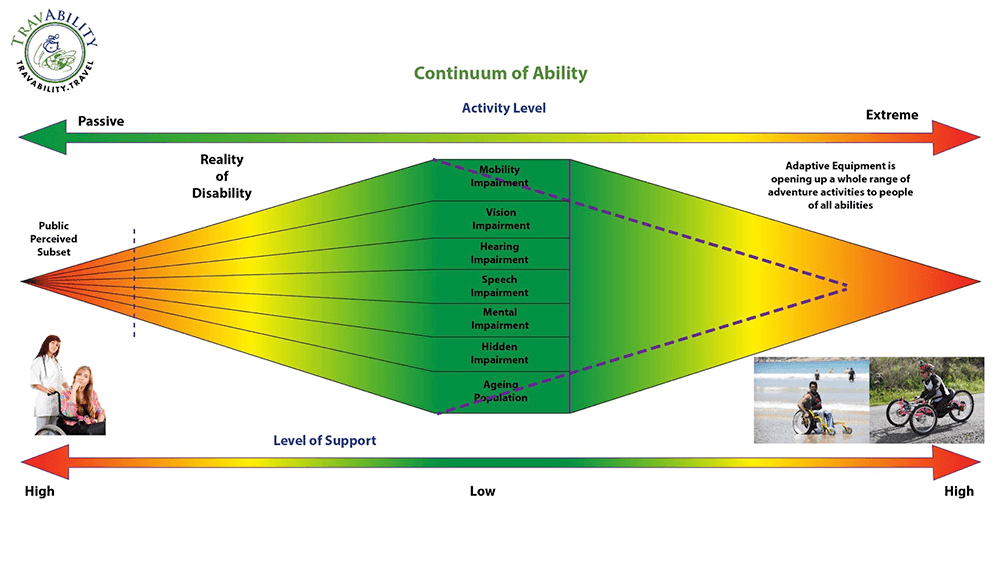

A disability, in reality is just a different level of ability. Physical ability is just one element in the total capability set of the human being.

Disability is the only minority group anyone can join in an instant

Disability is often regarded as a homogeneous concept. The opposite is true. As with the general population ability is on a continuum.

Tourism and Leisure are examples of well established and very intricate systems aimed at delivering a multitude of different experiences to the customer. The complexity exists both within the destination management structure and within the industry that brings together an array of components to deliver its overall service. A successful tourism/leisure product incorporates, transport, accommodation, attractions, booking systems, information systems and customer service. Those products are bundled and further require the integration of service providers, consolidators, tour operators and an extensive retail network whether online or offline.

Tourism and Leisure are examples of well established and very intricate systems aimed at delivering a multitude of different experiences to the customer. The complexity exists both within the destination management structure and within the industry that brings together an array of components to deliver its overall service. A successful tourism/leisure product incorporates, transport, accommodation, attractions, booking systems, information systems and customer service. Those products are bundled and further require the integration of service providers, consolidators, tour operators and an extensive retail network whether online or offline.

The campaign changed perceptions of both the travelling public and the tourism industry to wards Accessible Tourism as a mainstream market.

The campaign changed perceptions of both the travelling public and the tourism industry to wards Accessible Tourism as a mainstream market.

In Flanders (the northern region of Belgium), implementation of the tourist accessibility policy is in the hands of Visit Flanders. Visit Flanders is a government institution, whose key task is to promote and market Flanders as a tourist destination at home and abroad. Another important task is to develop tourism products

In Flanders (the northern region of Belgium), implementation of the tourist accessibility policy is in the hands of Visit Flanders. Visit Flanders is a government institution, whose key task is to promote and market Flanders as a tourist destination at home and abroad. Another important task is to develop tourism products